Taper relief reduces the tax payable where there are more than three years between the date of the gift and the date of death. Capital allowance is given to reduce the tax payable for the capital.

Special Tax Deduction On Rental Reduction

One can reduce their tax outgo by making full use of deductions under Section 80.

. This will be recorded by crediting increasing a deferred tax liability in the statement of financial position and debiting increasing the income tax expense in the statement of profit or loss. Get more out of your accounts payable process with automation. If you make the decision not to sell the PPOR residence after six years of renting it out the market value rule will be applicable to help potentially reduce your capital gains.

Overpaid Taxes Can Be Refunded In The Form Of A Tax Return. The NRWT rate on interest is 10 but is reduced to 0 if it is payable to eligible financial institutions. The normal rate of allowance is 60 on the qualifying capital expenditure and can be offset up to 70 of the statutory income of the company.

The NRWT rate on dividends is reduced to 5 if the beneficial owner is a company holding at least 50 of the voting power in the company paying the dividends and 15 in all other cases. Assuming that the tax rate applicable to the company is 25 the deferred tax liability that will be recognised at the end of year 1 is 25 x 300 75. Currently an overseas company with no permanent establishment in Malaysia would not be liable to register for Sales Tax or Service Tax.

Income Tax 101 with our easy to use calculator and tax guides. Total taxable income and tax payable. In the US taxpayers Taxpayers A taxpayer is a person or a corporation who has to pay tax to the government based on their income and in the technical sense they are liable for or subject to or obligated to pay tax to the government based on the countrys tax laws.

Central government Her Majestys Revenue and Customs devolved governments and local governmentCentral government revenues come primarily from income tax National Insurance contributions value added tax corporation tax and fuel dutyLocal government. Resignation Vacation or Death of Sole Director or Last Remaining Director. 40 000 or actual expense whichever is lesser.

This will entitle you to a 50 discount on your capital gains tax payable when you sell the property. Further details regarding the tax due on PETs at the time of a donors death are given later in this article. All employees in Malaysia should be issued with a payslip when they are paid including information such as wages earned and deductions made.

Monthly tax deductions in Malaysia are governed by the STD mechanism - which reduces the need for employees to pay tax in one lump sum. Learn the Basics. Understand the pros and cons for each card and discover the features.

The income statement classification of consideration payable in the form of an equity instrument depends on whether the payment is in exchange for a distinct good or service as discussed in RR 461. If the donor dies within seven years an IHT charge will arise and tax will be payable by the donee. Income tax rebate in India is made available for Hindu Undivided Families HUF and individuals who reside in India.

Capital Allowance is used as a subsidy to for the depreciation of fixed assets. The start-up costs will be allowed as tax-deductible costs over a period of four years on a straight-line basis at the rate of 25 per annum. Kuala Lumpur Kepong Berhad KLK is a company incorporated in Malaysia and listed on the Main Market of Bursa Malaysia Securities Berhad with a market capitalisation of approximately RM21687 billion at the end of September 2021.

Accounts payable automation software helps organizations pay for invoices in an organized timely manner for the precise amounts. Taxpayer can claim tax rebates for Rs. How Does Monthly Tax Deduction Work In Malaysia.

Get the most out of Malaysias banks and finance companies when you save invest insure buy and borrow. For the purpose of appointing a new director in the event of the office of a sole director or the last remaining director of the company being vacated the secretary shall as soon as practicable call a meeting of the next of kin other personal representatives or a meeting of members as the case may be. Supplementary dividend tax credit regime.

Calculate payment under 21B of RPGTA. Marginal Tax Rate US. See all open career opportunities at FLSmidth.

These have been prescribed under section 44AA and Rule 6F. This wont always be the case however. Taxation in the United Kingdom may involve payments to at least three different levels of government.

Often when the comparison is between a pension payable immediately such as taking early retirement from the company and trying to duplicate the same income by commuting the upfront tax hit on the non-transferrable portion will make the company retirement plan almost impossible to beat. The individual has to submit the necessary documents to the HR department and they will apply lesser TDS on his salary. Credit Card Reviews Reviews for the top credit cards in Malaysia.

Compute tax payable automatically. The Income Tax Act has specified that the books of accounts must be maintained for the purpose of Income Tax. Calculate Exemption under PU.

Businesses often receive thousands of invoices each day and processing them all requires time effort and resources. Find Out Which Taxable Income Band You Are In. Calculate Tax Relief for loss on disposal automatically.

Consideration payable to a customer could be in the form of an equity instrument for example shares share options or other equity instruments. Calculate allowable loss automatically. The nature of the capital and the purpose of.

These Are The Personal Tax Reliefs You Can Claim In Malaysia. - Handling external and internal audit on finance matter - Risk Management. Capital allowance is only applicable for businesses and not individuals.

- Manage tax related matter. Read more are bifurcated into seven brackets based on their taxable income. Heres How A Tax Rebate Can Help You Reduce Your Tax Further.

Interest is deductible if the interest is incurred in respect of a debt obligation by the company in the production of income included in the companys gross income. Allow to key multiple disposers and acquirers and generate related forms automatically. The tax incentive given under ITA is in the form of allowance in addition to the capital allowance on qualifying plant and equipment acquired by the company during the ITA period ie.

However from 1 January 2020 foreign service providers of digital services to consumers in Malaysia exceeding MYR500000 per year will be liable to register for Service Tax. In that Section 80C of the Income Tax Act offers tax.

What Are The Tax Reliefs Ya 2021 In Malaysia

What Is A Homestead Exemption Protecting The Value Of Your Home

Does E Filing Reduce Tax Compliance Costs In Developing Countries

Some Of The Best Methods To Prevent Tax Evasion Enterslice

Orisoft Is The More Famous Software Company In Malaysia To Get These Services Easily Like Human Resource Software Hr Management Payroll Software Management

Find Out How A Tax Rebate Can Help You Reduce Your Tax

New Tax Preferences To Support Ukraine Kpmg Poland

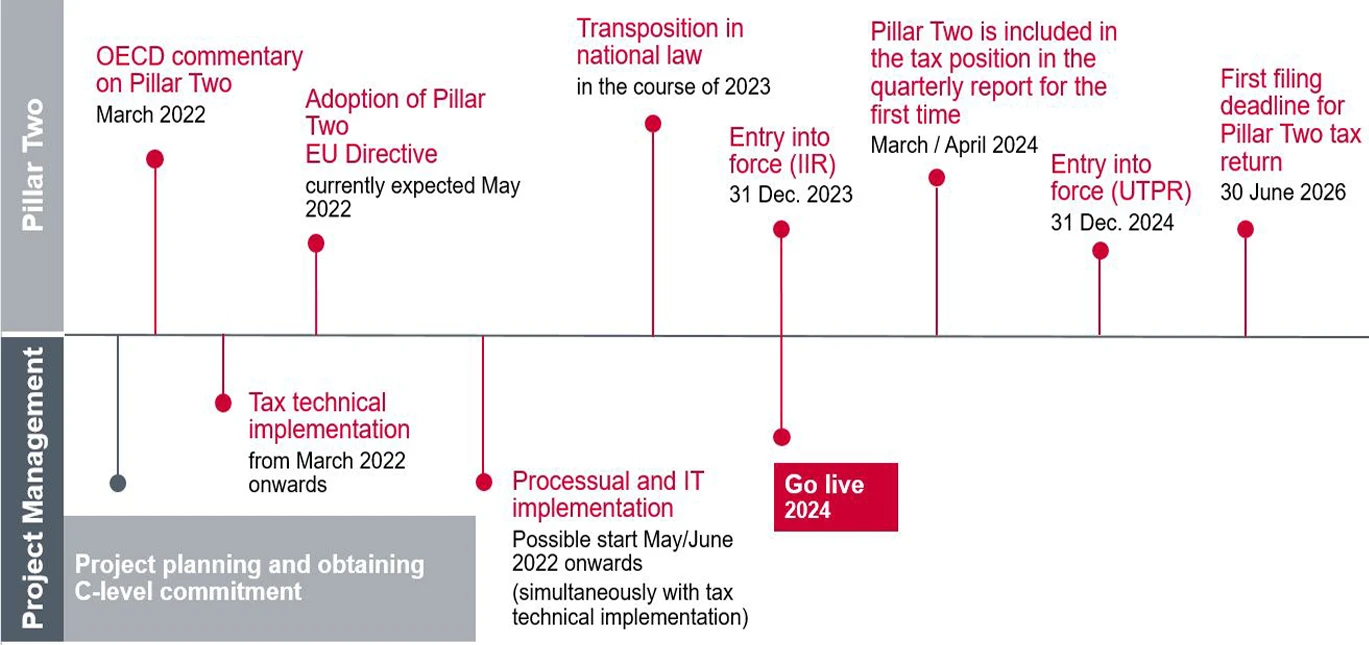

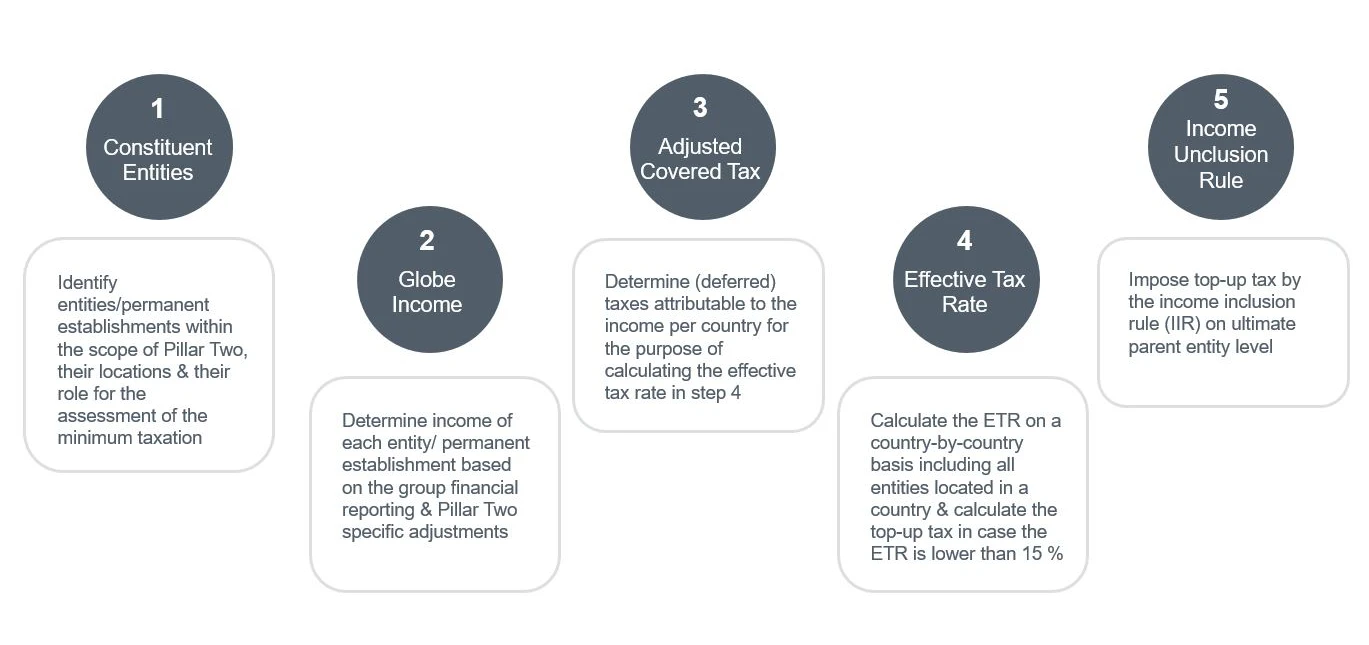

Pillar Two Global Minimum Tax Wts Global

Pdf The Relationship Between Tax Evasion And Gst Rate

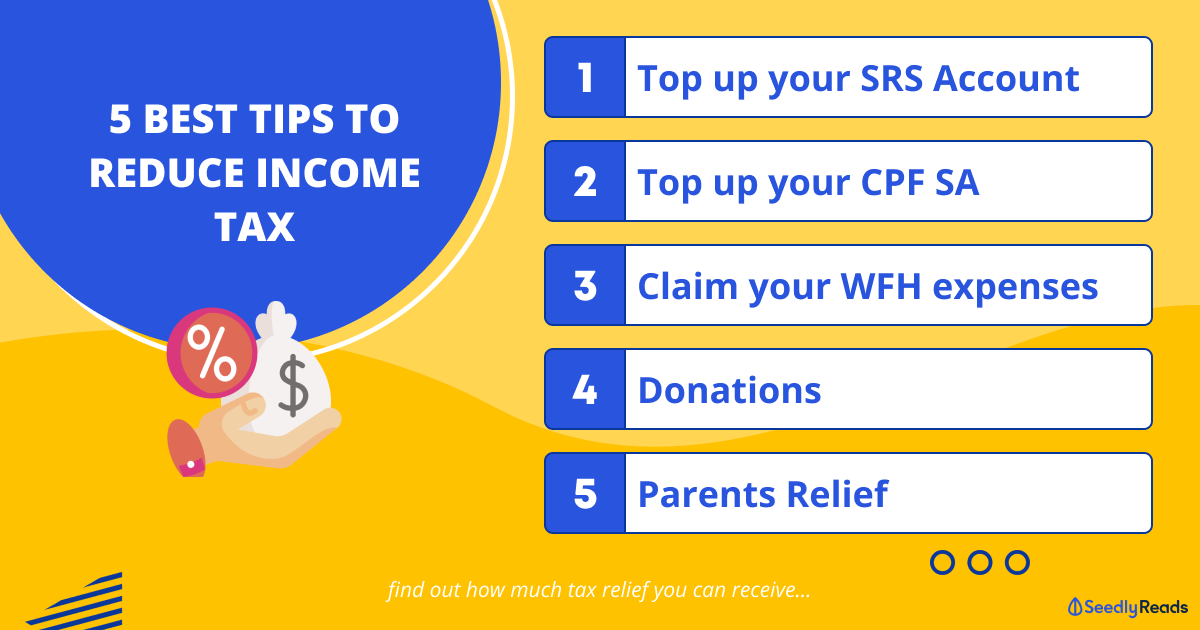

Top 5 Tips To Reduce Income Tax In Singapore

Income Tax For Sole Proprietors Partnership In Malaysia 2020 Updated

Special Tax Deduction On Rental Reduction

Pillar Two Global Minimum Tax Wts Global

Updated Guide On Donations And Gifts Tax Deductions

Corporate Tax Malaysia 2020 For Smes Comprehensive Guide Biztory Cloud Accounting

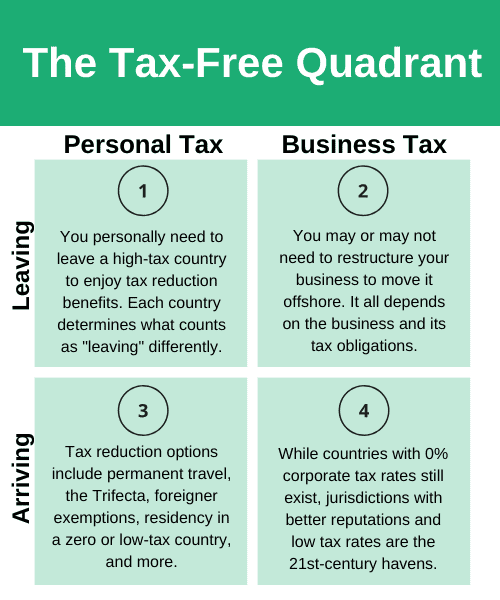

Entrepreneurs Here S How To Pay Less Taxes

/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)

/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)